Our Data Advantage

Accurate Data for

Private Markets

While other vendors rely on low-quality data scraped from PDFs, websites, and FOIA requests, CEPRES has established a secure network of over 17,200 funds for the direct exchange of granular, accurate investment data. Whether you need data for due diligence, portfolio analysis, or market research, only CEPRES can deliver the high-quality investment data essential for private markets.

Today, CEPRES runs the largest data pipeline network between investment decision makers.

Our Solutions

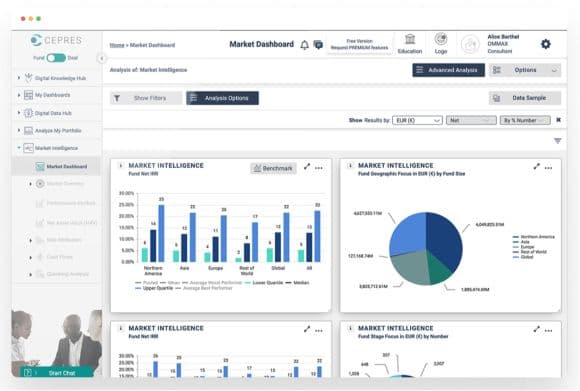

Unlock Data Driven Insights for Private Markets Portfolios

Get the best portfolio data and analytics for Private Equity, Venture Capital, Private Credit, Real Estate, Infrastructure, and more. Plan your commitments, underwrite new managers, monitor your funds and portfolio companies, and forecast cash flows — all from a single, integrated platform.

Learn moreAccess the most accurate and comprehensive data on private market funds and deals. We are trusted by leading LPs and GPs for market research, strategy, benchmarking, and deal comparisons to gain a competitive edge.

Learn moreFind out how our products will benefit you

THIS IS WHAT OUR CLIENT BVV SAYs

Alexander Kehl, Portfolio Manager Private Equity Investments at BVV, says

"We work exclusively in the interest of our members — a basic principle that has proven itself to this day, and CEPRES was a natural fit for our investment team. CEPRES provides unrivaled look-through data access and more intelligent analytics insight into the growth drivers and, therefore, future development of our investments. This is the basis for our investment decisions in times of increasing volatility."

"CEPRES empowers leading investors to make superior investment decisions with gold-standard data and portfolio analytics for due diligence, portfolio management, market research, and more. With the world’s largest private markets data ecosystem, we help clients improve investment outcomes across the private markets."

Dr. Daniel Schmidt

Founder and CEO

The pioneer of data exchange

World-class partnerships

Connection has been at CEPRES’s core since day one. We are proud to partner with some of the most prominent and influential companies in the private market space.

Key USPs

Best in class, bullet-proofed

Data accuracy

Stop correcting poor quality data scraped from reports. Through CEPRES, connect directly to >17,200 funds for the most detailed and accurate look-through data from GPs internal records. All backed by CEPRES Gold-standard quality assurance.

Analytics at your fingertips

Don’t wait for weeks for key analyses. With 1,000s of investment metrics out-of-the box and point & click custom private equity analytics ready in minutes you can meet all your investment decision needs in real-time.

End-to-end solution

Combine portfolio monitoring, due diligence, fund/deal benchmarking and cash pacing, all in one integrated system to achieve deeper insights and better decisions on your portfolio.

Collaborate and network

CEPRES is built for collaboration to drive growth and competitive advantage. GPs can securely share data with their LPs and Investment Professionals can share insightful analytics with colleagues and clients.

The data platform built for private markets

The data platform built for private markets

CEPRES gives investment professionals the edge they need to make smarter, faster decisions across the entire deal lifecycle. From fundraising and due diligence to portfolio monitoring and risk assessment, CEPRES delivers verified, granular insights sourced directly from GPs - not scraped, not estimated. Powered by the industry's most trusted, verified data from 17,200+ funds and 150,000+ deals, CEPRES turns complexity into clarity so you can act with confidence, backed by the most trusted data in the industry.

OUR LATEST CONTENT

Thought Leadership

15.12.2024 /

REPORT

CEPRES 2025 Private Credit Outlook

As we move into 2025 with a 50 basis point rate cut already implemented, private credit faces a mixed yet promising outlook. Private credit is directly impacted by these rate changes.

Read full article26.05.2024 /

WHITEPAPER

AI in Private Capital Markets Balancing Risks and Unlocking Benefits

Artificial Intelligence is reshaping how private capital investors operate across the entire investment lifecycle. In a market saturated with complex, disparate data – from regulatory filings to earnings call transcripts and market sentiment – AI offers a powerful solution to accelerate analysis, personalize insights, and enhance decision-making quality. Find out what you need to look out for.

Download the Whitepaper26.05.2025 /

CHECKLIST

Choosing the Right AI for Private Market Investing in 2025

Artificial intelligence is reshaping the private markets landscape – but not every solution is the right fit. As AI tools proliferate, choosing one that meets the unique challenges of private market investing is more critical than ever. Discover the key factors you need to consider to unlock AI’s full potential while mitigating risks.

Download the Checklist26.05.2025 /

ONE PAGER

CEPRES AInsights: Transforming Private Capital Markets

As private capital markets become increasingly complex, leveraging data-driven decision-making is essential for staying ahead and making informed investment choices. Find out how CEPRES AInsights helps LPs and GPs to extract meaningful insights quickly and efficiently.

Download the One PagerEager to improve your decision making?

Contact our Experts and experience how CEPRES can help you

CEPRES is the leading private market investment data platform. Start unlocking better investment outcomes.- Optimize portfolio monitoring for greater efficiency and insights

- Enhance the depth and precision of performance analysis via real market data

- Identify and assess potential investment opportunities

- Access the world’s most comprehensive private markets data ecosystem