The black swan event that is the coronavirus is exacerbating already existing systematic risks in private market portfolios for some industries. It is by no means the same as the global financial crisis and we see different idiosyncratic outcomes, but some similar trends.

"Growth equity investments in sectors such as tech not only remained unscathed during the GFC, they could also benefit from the covid-induced new normal.”

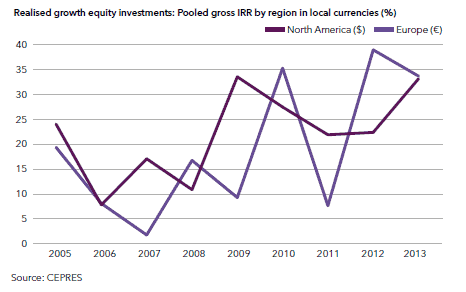

Daniel Schmidt, CEO & Managing Partner, CEPRES

Read the full article by Dr. Daniel Schmidt in the June issue of Private Equity International.