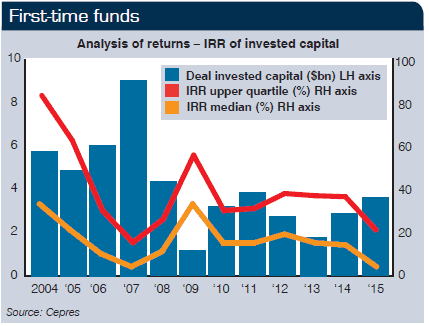

Read the latest article by Elisângela Mendonça from Private Equity News/Dow Jones, on how first-time funds have proven their worth in the aftermath of a crisis, with new data showing they outperformed more mature strategies following the global financial crisis. According to Cepres investment analyst Jinfang Shi, first time funds can potentially repeat the success they had after the global financial crisis following the disruption caused by Covid-19, because the managers continue to behave in similar ways. Read the full article featuring CEPRES data here!

Read next

Whitepaper | Private Markets Look-through Data

In an era of political and macro-economic uncertainty, access to granular and accurate knowledge on investments is critical to meet portfolio challenges and goals. With accurate investment data, rather than guessing, you can unearth deeper insights, detect risk patterns, and uncover opportunities that elude those using only basic financial reports.

Download our whitepaper as we navigate the complexities of today's political and macro-economic uncertainty.

Private equity advisory and its role in the investment process

Private equity advisory plays a crucial role in guiding clients through various stages of the investment process, from deal origination and due diligence to execution and exit strategies.

Whitepaper | Private Markets Look-through Data

In an era of political and macro-economic uncertainty, access to granular and accurate knowledge on investments is critical to meet portfolio challenges and goals. With accurate investment data, rather than guessing, you can unearth deeper insights, detect risk patterns, and uncover opportunities that elude those using only basic financial reports.

Download our whitepaper as we navigate the complexities of today's political and macro-economic uncertainty.

Private equity advisory and its role in the investment process

Private equity advisory plays a crucial role in guiding clients through various stages of the investment process, from deal origination and due diligence to execution and exit strategies.